Tuesday is also the date for the release of October PPI and Retail Sales. The October number will be used as an indicator of Christmas sales, as it comes on the heels of lower gas prices and some softening in consumer optimism. CPI is reported on Thursday.

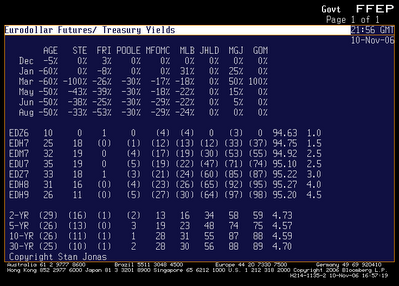

Data plus the Fed means market volatility. Table below outlines the risks entailed. Market is pretty much set at the Poole scenario (things work out as we expect and we will give 25 back). But if we move back to 0%, there is 34 basis points of risk in the 2-year. To be forewarned . . . . . .

No comments:

Post a Comment