The Jan meeting will tell the tale. IF the Q4 data are as weak or weaker than Q3, Fed eases right then and there -- they are not going to wait til Mar, May or Jul. Poole told us, no moderation on the downside if the wheels are coming off the economic bus. IF the Fed holds in Jan, it means that their forecast of moderate growth unfolded as expected. Should that be the case, do you think all that ease priced into the red and green Euros holds?

Right now, market is pricing a 10% or so chance of an ease in Jan while looking for 60 basis points through 2007. One interpretation is 60% chance of 100 basis points in eases. Another way to parse it is certainty on 50bp and 40% on the next 25. Either way, the eases are loaded into the warm weather months. Seems to me, if you believe the economy is weaker than the Fed is letting on, always a possibility, cheaper to buy the call on Jan and hedge it up with cheap puts in Sep 07 or Dec 07. As always, these are ideas best discussed with people who understand your financial situation and no guarantees are being made or implied.

Let's confuse the GDP growth story with some facts.

Having a weak quarter during an expansion is, by itself, not unusual. We all like to think in trend terms, but there is very little correlation in real growth from quarter to quarter. There is a lot of basic algebra determining the next quarter based on the current one. High number raises odds of lower one in the next period, and visa versa. It can get a bit more detailed, such as using the monthly pattern, but suffice it to say that for the 4th quarter to look weaker, lots of activity has to weaken further since housing doesn't drop another 17% -- unless we want to take down all the growth from inventory liquidation. Which is always possible, as is the likely reversal of that strange growth number for auto production.

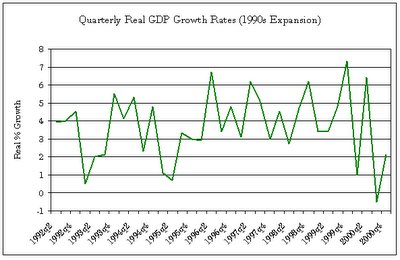

Every quarter has its "special factors" that, over time, are forgotten as we examine past patterns of real growth. The chart below shows the pattern of quarter to quarter growth during the 90s expansion. The variability and how strong quarters follow weak ones, etc. are clearly evident.

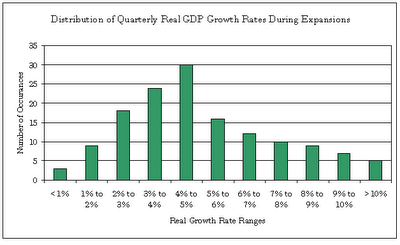

As for my comment about getting a weak quarter during an expansion, you can see that in the chart above and in this histogram below. The graph counts out the number of quarters registering growth rates in different buckets during expansions (as defined by the NBER) beginning with 1960. Note that 21% of the quarters had growth rates of less than 3% and of those 40% was less than 2%. Point here is that while there is a clear central tendency, as one might expect, there is also a clear dispersion that makes straight line forecasting from one quarter's growth rate a tricky business.

Lastly, the 3Q numbers are weak exactly where the Fed expected them -- in residential housing. The capital spending and consumption data say that the drop in housing hasn't spilt over. The Fed's outlook is that the worst in housing is over. Accepting that plus lower mortgage rates, lower gas prices, higher confidence numbers, and ongoing credit creation, why can't Q4 turn out as the Fed expects -- moderate (under 3%) real growth? From here, it looks like the Fed holds again in Jan (Dec on hold is a foregone conclusion). Given that, why do those back Euros keep getting richer?

2 comments:

Order Cialis, Viagra, Levitra, Tamiflu. Order Generic Medication In own Pharmacy. Buy Pills Central.

[url=http://buypillscentral.com/buy-generic-brand-levitra-online.html]Purchase Cheap Viagra, Cialis, Levitra, Tamiflu[/url]. canadian generic pills. Cheapest drugs pharmacy

When you sort Viagra or some other meds in our betray you may be established Best Discount Cialis Pharmacy On-line that this issue single of pre-eminent distinction bequeath be delivered to you positively in time.

Post a Comment