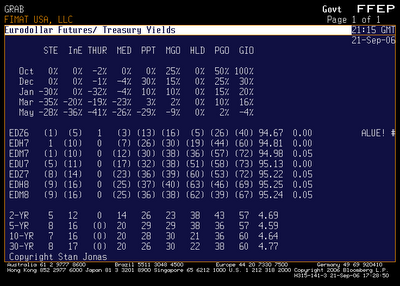

Here below is the current state of probability affairs as lifted from the Bloomberg page set out by my partner, Stan Jonas, and used to help feed the trading strategies of our fund (this is not a solicitation, etc, etc, etc, merely full disclosure on my part)

The interesting point here is the Thur column which lays out the probablities implied by current pricing. The market is setting the odds at 1 in 3 of a cut in January, 1 in 5 in Mar and 2 in 5 by May. Cumulatively it adds to certainty by the May meeting.

As for expectations between now and year end, the no change view has gone from 66% to 82%. In that 18% betting on one move or another, it was 2 to 1 or 3 to 2 in favor of a tightening. Today it swung the other way and sits at 2 to 1 in favor of an ease: 12% to 6%. These numbers are garnered from the Fed funds digital options that trade on the CBOT.

It seems that once the Fed stops, the market just has to believe the next move is an ease. History favors this view, no doubt, but when everyone sees it, something else suprises. The only real indicator to me that the economy is slowing is the drop in oil to $60/bbl. Since I believed growth and not a contrived shortage was driving the price up, I have to remain consistent in my logic.

There is, however, another aspect to lower yields and reduced oil prices. They are in and of themselves a buffer to weaker growth. Knowing this, the Fed shows no inclination to micro-manage the economy by changing rates 25bp from neutral (where we are now). With Fed funds neither constraining or subsidizing growth in the aggregate, the Fed seems perfectly content to let the economy fluctuate around some trend path, pushed and pulled by shifts in relative prices. Let market participants draw strong trends from single data points, the Fed will have none of that in its own decision making process.

The Fed is out of the way, the bigger disappointment to the market will not be that they have tightened too much but that they did just enough.

3 comments:

Oddly,the Fed Philly Index which was reported on September 5,2005 fell from 17.5 the prior month to 2.2.Curious.

And the year before the Index dropped from 27.9 to 19.8. I did give a cursory look to see if there was a seasonal of sorts and it appeared there might be. A key point here is that once the Fed stopped the market needs a bet that they do something, historic odds favor the ease so any info supporting that view gets jumped on. I wonder if anyone has put these regional indexes through a seasonal adjustment process to see the results.

key point here is that once the Fed stopped the market needs a bet that they do something, historic odds favor the ease so any info supporting that view gets jumped on.

Exactly,you said it best in your previous missive....be long at your own risk.

Post a Comment